We’re in the middle of a banking crisis1 and no one seems to know what is going to happen in the next 15 minutes, let alone the next 15 days. Here’s what I know after hours of reading everything I could on it this morning:

Everything is going to be fine and we are already nearing the bottom, or everything is not going to be fine and the bottom can’t even be seen from here.

So. I hope that clears things up for all of us.

The Fed seems poised to continue raising interest rates on Wednesday, a move that will hurt people more than companies. I asked on Twitter what the government could do to calm inflation while not raising rates. I really loved this answer:

“Regulation on price gouging and limiting price increases from corporations. A huge segment of inflation right now is just corporations increasing prices because they can for the sake of profits.”

(Of course, Twitter continues to be broken and will not let me link to this reply from @alisha_ann94 But you can find the reply and my initial typo-filled question here.)

She’s totally right. And I really loved this from the Economic Policy Institute. It’s worthwhile to read the whole thing, but the TLDR is:

In short, the rise in inflation has not been driven by anything that looks like an overheating labor market—instead it has been driven by higher corporate profit margins and supply-chain bottlenecks. Policy efforts meant to cool off labor markets—like very rapid and sharp interest rate increases—are likely not necessary to restrain inflationary pressures in the medium term.

Other tools that would be less damaging to typical families—like care investments to boost expected growth in labor supply or a temporary excess profits tax—could be effective in tamping down inflation over the next year and should be a bigger part of the policy mix.

Also appreciated this from Andrew Certain, who is really a continual source of understanding for me. (Why does Twitter let me link this one and not the other one? I DON’T KNOW! Elon FIX YOUR SITE!) Higher rates will fuel the unemployment rate and unemployment strips workers of power. You know all the buzz about workers gaining power and The Great Resignation? Well, companies are sick of it. They want the power back.

It's not clear to me that the current level of inflation is bad for workers. Workers need more power to keep more value, and unemployment reduces their power dramatically. Notice there are a lot of rich business owners putting forth the argument that inflation is bad for workers.

— Andrew Certain (@tacertain) March 20, 2023

Aside from inflation, it should seem obvious to everyone that Elizabeth Warren is right that the SVB bank failure is a symptom of regulatory failure.

“Donald Trump ran for president saying he would lighten the regulations on these banks,” Warren said during an interview on CBS’s “Face The Nation.” “And then Jerome Powell just literally took a flamethrower to these regulations, in order to make them less and less effective.”

It’s wild to me that he and Trump repealed some of the most vital regulations introduced in the wake of the 2007-2008 crisis. How quickly people forget when power is at stake. I do not understand why Biden re-appointed Powell last year. Warren opposed the re-appointment at the time. I guess I’d just like men in power to start forking listening to her once in awhile.

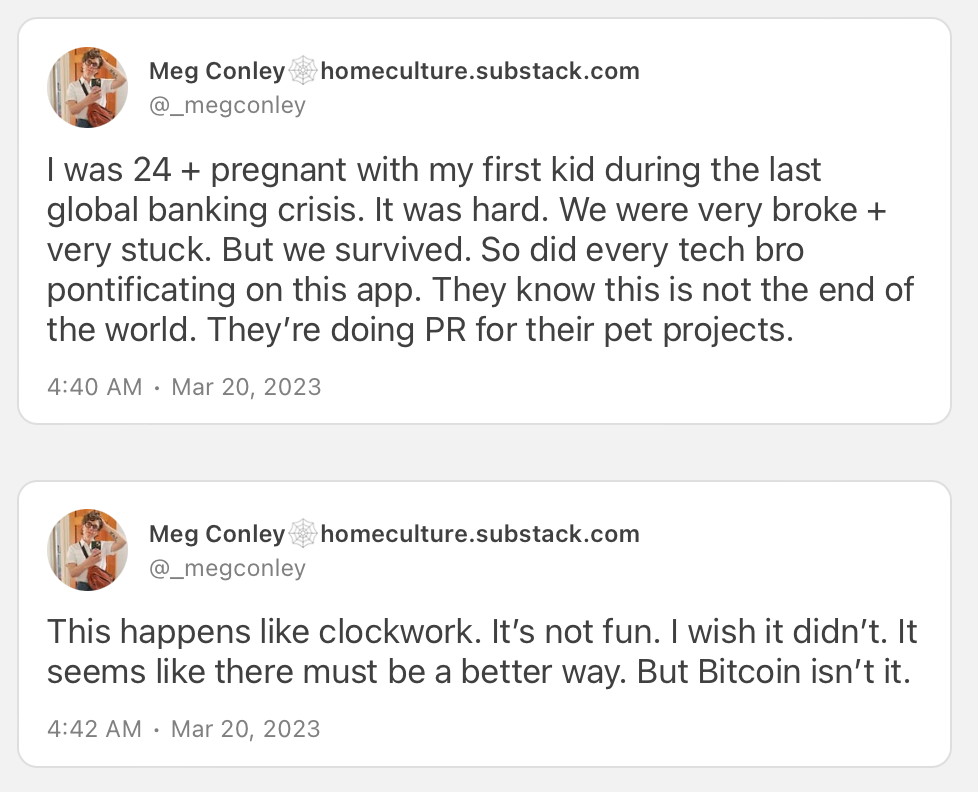

I personally do not think this turns into a protracted global crisis like the 2007/2008 GFC. That crisis was precipitated by an already declining economy and the bursting of the speculative housing bubble. The details are different, as are the resources available. It’s possible a soft landing has turned into a hard landing, but there’s no reason for us to crash. Well, no reason as long as leadership and tech bro bitcoin accelerationists don’t succeed in making it worse. And for many people in both groups - and where the groups overlap - making it worse is like their favorite thing to do.

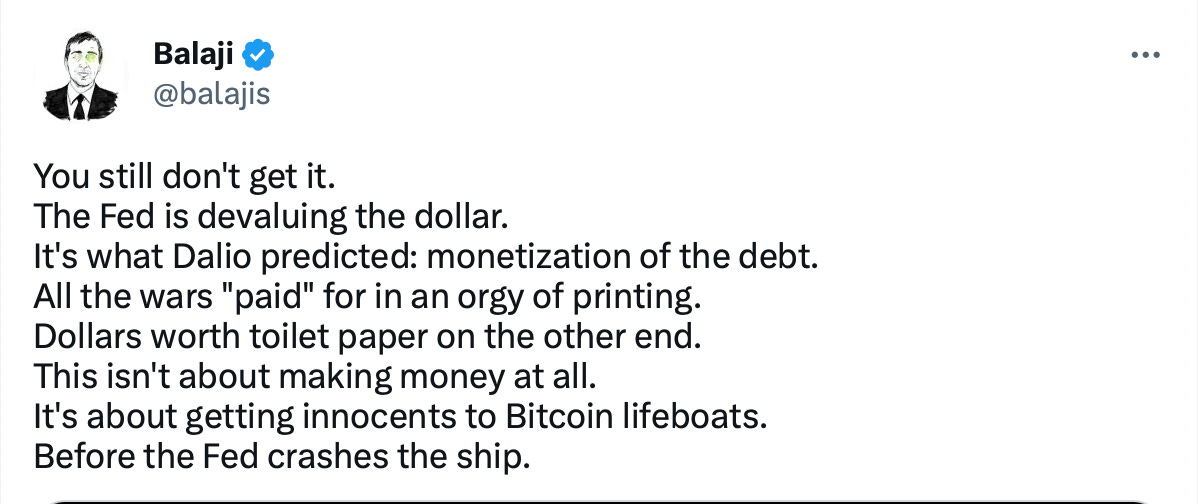

This guy is claiming inflation is about to turn to hyperinflation. And that it will happen so quickly, and so comprehensively, Bitcoin - currently worth around $27,000 - will be worth $1 million in 90 days. If hyperinflation got that bad, that quickly, it would be a Bronze Age Collapse event.

It’s unclear to me how a blockchain based currency survives in a world where the global market has broken down that thoroughly. Blockchain is a decentralized network stored on users’ computers all over the world. In a hyperinflated world, where government breakdowns mean electricity is only available a couple hours a day, the network will go down.

Does a Bitcoin have worth if there’s nobody there to turn the computer on?

I’ve got a newsletter coming out about this dude and the other dudes he colludes with this week. Until then, let me just say….

If someone is telling you it’s the end of the world, they’re selling you religion or Bitcoin. Or both.

So after hours of spinning through commentary on interest rates, liquidity, Lehman Brothers, bitcoin maximalists and everything else, I want to ground myself in your stories. Maybe you’ll feel grounded in each others stories, too.

Because no matter what happens in the next 15 minutes or 15 days or 15 years, your stories are the story that really matters. But that big story will go untold, unless we share our stories in safe spaces and keep them written on our hearts. You know, it occurs to me that in so many ways, that’s what we’re doing here as a community. Sharing ourselves like a secret poem we’ll recite together when the trouble clears.